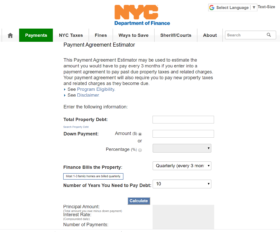

Department of Finance Payment Calculator Image Credit: Department of Finance

Department of Finance looks to ease tax burden on homeowners through deferment programs and suspension of the annual tax lien sale. On March 24, 2020, the Department of Finance announced several measures intended to assist property owners with their tax payments amidst the COVID-19 outbreak. With unprecedented unemployment rates, many throughout the city will have difficulty paying their taxes come the close of the fiscal quarter and going forward. Each of the following programs is aimed to lower the amount of taxes owed and provide payment plans for those individuals who qualify. The programs are as follows:

Exemption Programs

The Department of Finance offers several benefits in the form of tax exemptions, abatements and various money-saving programs. Exemptions lower the amount of tax owed by a property owner by reducing a property’s assessed value. An abatement reduces taxes through the application of credits to the annual amount of tax owed. For more information on exemption and abatement programs click here.

Standard Payment Plans

Taxpayers may also agree to a payment plan. In this scenario, the Department of Finance will offer a personalized payment plan that requires a property owner to agree to pay a total amount owed over a period of time, instead of paying the full amount all at once. The existence of a payment plan will prevent enforcement against a property. Payment plans are offered to owners of all properties. These plans usually require a down payment (sometimes as low as zero dollars) and spread the repayment over a period that can be as long as ten years. Interest will generally be charged on the outstanding balance.

Property Tax and Interest Deferral program (PT AID)

If a property owner qualifies for the Property Tax and Interest Deferral program, they may defer their property tax payments or pay a small percentage of their income to ensure they can stay in their home. For temporary hardships, the deferment would be for a fixed period of time. If there is a chronic hardship that period may be further extended. The amount a property owner may defer is limited to a maximum of 25 percent of the owner’s equity for one-, two-, three-family homes and up to 50 percent of equity in a condominium unit. The three payment plans are as follows:

- Extenuating Circumstances Income-Based (ECI) Plan—Homeowners experiencing extenuating circumstances can enter into a payment plan which limits their payments to a maximum of 8 percent of their adjusted gross income while the hardship persists. Extenuating circumstances, according to the Department of Finance, involves the death or serious illness of a property’s owner or immediate family member, loss of income, or enrollment in the Department of Environmental Protection’s Water Debt Assistance program. In order to qualify for the program, the property must be a class 1 residential property, or condominium, the property was the applicant’s primary residence for a year, the applicant has a federal adjusted gross income of no more than $58,399, and the applicant must have the ability to document the extenuating circumstance.

- Low-Income Senior Plan—Senior homeowners experiencing hardship may fully or partially defer payment of both delinquent and future property taxes for either a fixed or indefinite period of time. Those seniors would have the option to pay 0 percent (full deferral) 25 percent, 50 percent or 75 percent of the delinquent and future property taxes. In order to qualify for this plan, the property owner must be at least 65 years old, the property is a class 1 residential property or condominium, the property must be the taxpayer’s primary residence and the taxpayer may not have a federal adjusted gross income greater than $58,399.

- Fixed-Term Income Based Plan—A property owner may also enter into a payment plan which limits their payments to 8 percent of their adjusted gross income. This plan includes the delinquent amount or the delinquent amount plus charges projected to be due over the next year. To qualify for this program, the property must be a class 1 residential property or a condominium, the property was the applicant’s primary residence and the taxpayer does not have a federal adjusted gross income greater than $58,399.

The Department of Finance Commissioner Jacques Jiha stated “these are unprecedented times for New Yorkers, many of whom find themselves struggling to make ends meets,” adding, “through our programs, DOF hopes to ensure we do our part to help those who are struggling have one less burden to deal with as we work toward economic recovery.”

To find more information about the property payment plan and applications for the plan, click here. For information and the application for the Property Tax and Interest Deferral program click here. Completed applications and supporting documentation for both stand payment plans and the Property Tax and Interest Deferral program may be emailed to PTAID@finance.nyc.gov. The Department of Finance has also provided an online payment calculator to help property owners estimate how much they might pay under the various plans.

On March 31, 2020, Mayor de Blasio announced that the City will postpone its annual tax lien sale. In a press release, the Mayor’s office recommended that property owners facing hardships making their property tax payments take advantage of the existing Department of Finance programs listed above.

For New York City-specific COVID-19 updates, the City has established an information site with updates from all major administrative agencies. Agencies include the Department of Buildings, City Planning, Citywide Administrative Services, the Department of Finance and the Department of Transportation amongst others. You can find that page here.

By: Jason Rogovich (Jason Rogovich is the CityLaw Fellow and New York Law School Graduate, Class of 2019)