On February 12, 2025, the Department of Finance announced the launch of a series of outreach events to provide support and information for property owners who are at risk of having liens sold on their properties. The events will be held in partnership with other City agencies, the City Council, and non-profits. Property owners can learn more information about how to resolve outstanding property taxes, water and sewer fees, and other similar charges.

Department of Finance

Dept. of Finance Launches Property Tax Exemptions Look Up Tool

On March 27, 2024, the Department of Finance released a new application status tool for property owners to check the status of their property tax benefit applications. The lookup tool, at www.nyc.gov/exemptionstatus, will also allow New Yorkers to request more information if their applications are incomplete.

Dept. of Finance Announces Notice of Property Value Sessions for Each Borough

The first session is tonight in Brooklyn, with additional sessions to follow. On February 3, 2023, the NYC Department of Finance announced a citywide series of Notice of Property Value (NOPV) information sessions. Property owners received a Notice of Property Value from Finance in January. The Notice of Property Value provides information about market and assessed value and other relevant information so that owners can review the information ahead of the finalization of the assessment … <Read More>

The first session is tonight in Brooklyn, with additional sessions to follow. On February 3, 2023, the NYC Department of Finance announced a citywide series of Notice of Property Value (NOPV) information sessions. Property owners received a Notice of Property Value from Finance in January. The Notice of Property Value provides information about market and assessed value and other relevant information so that owners can review the information ahead of the finalization of the assessment … <Read More>

Department of Finance Extends Fine and Interest Reduction Enabling Recovery Program

The program provides financial relief during the pandemic for New Yorkers who owe fines and penalties. On December 20, 2021, the Department of Finance announced that its Fine and Interest Reduction Enabling Recovery (FAIRER) Program would be extended through March 20, 2022. The program allows New Yorkers to pay a reduced amount in fines to resolve eligible Environmental Control Board (ECB) judgments.

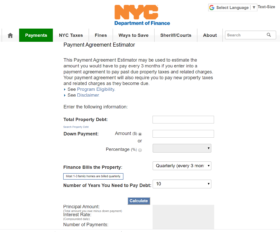

City Offers Payment Plans and Deferral Programs for Property Tax Payments

Department of Finance looks to ease tax burden on homeowners through deferment programs and suspension of the annual tax lien sale. On March 24, 2020, the Department of Finance announced several measures intended to assist property owners with their tax payments amidst the COVID-19 outbreak. With unprecedented unemployment rates, many throughout the city will have difficulty paying their taxes come the close of the fiscal quarter and going forward. Each of the following programs is … <Read More>